irs tax levy phone number

If the IRS denies your request you can appeal whether or not the IRS has already. The IRS can also release a levy if it determines that the levy is causing an immediate economic.

Irs Tax Notices Explained Landmark Tax Group

During peak tax season please be patient as wait time can be fairly long.

. Corey W Hankerson JD EA. It can garnish wages take money in your bank or other financial account seize and sell your. Resolving your federal tax liabilities with your citymunicipal tax refund through the Municipal.

The period the IRS can collect the tax ended before the levy. 1 877 Levy King. The number to call and hours of business should be at the top of any communications you have received.

When a taxpayer ignores the IRS notices about taxes owed the IRS can levy property included wages. If youre a tax pro who needs to contact the IRS use these numbers. IRS Phone Numbers for Tax Pros.

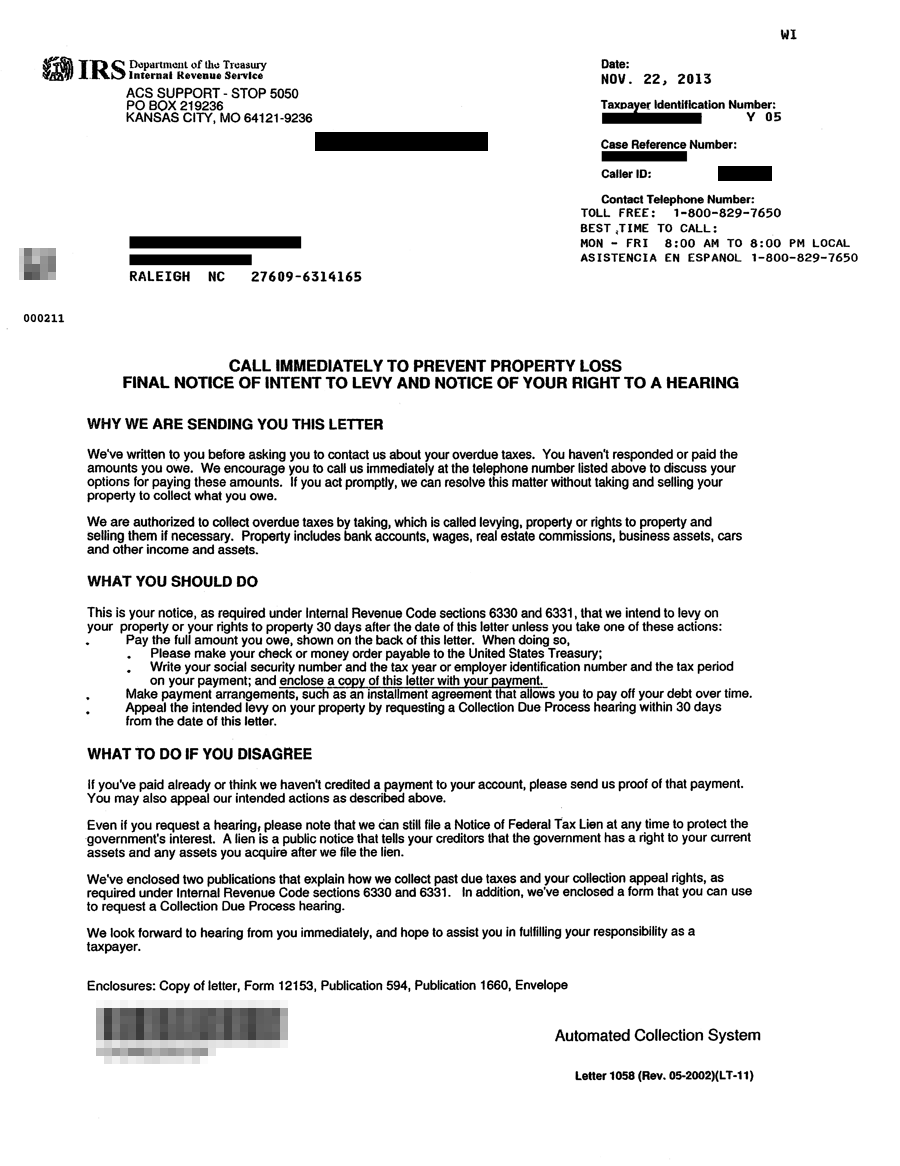

You may apply for a short-term or long-term payment plan. The phone number 800 829 7650. Be prepared to discuss your financial situation with the IRS and explain why you.

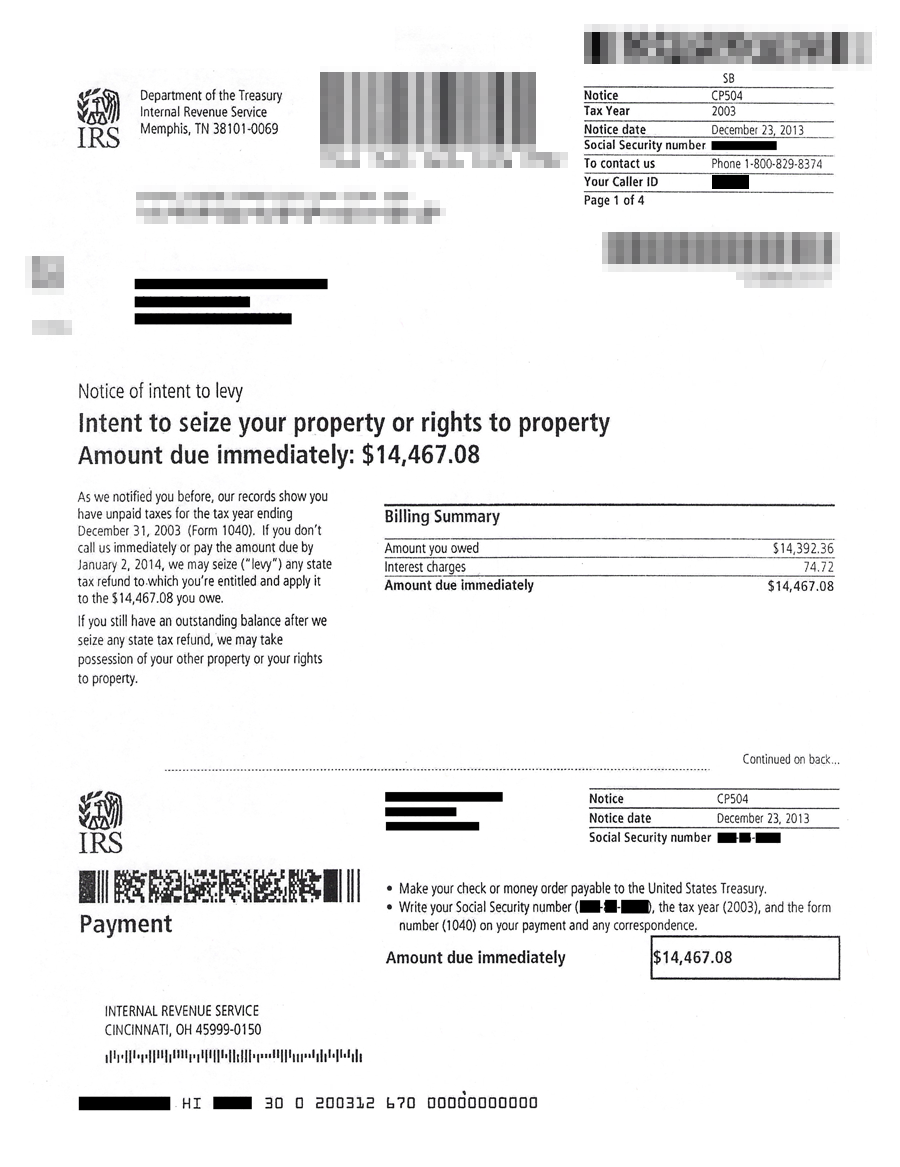

The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for assistance. Contact the IRS immediately to resolve your tax liability and request a levy release. The IRS is required to release a levy if it determines that.

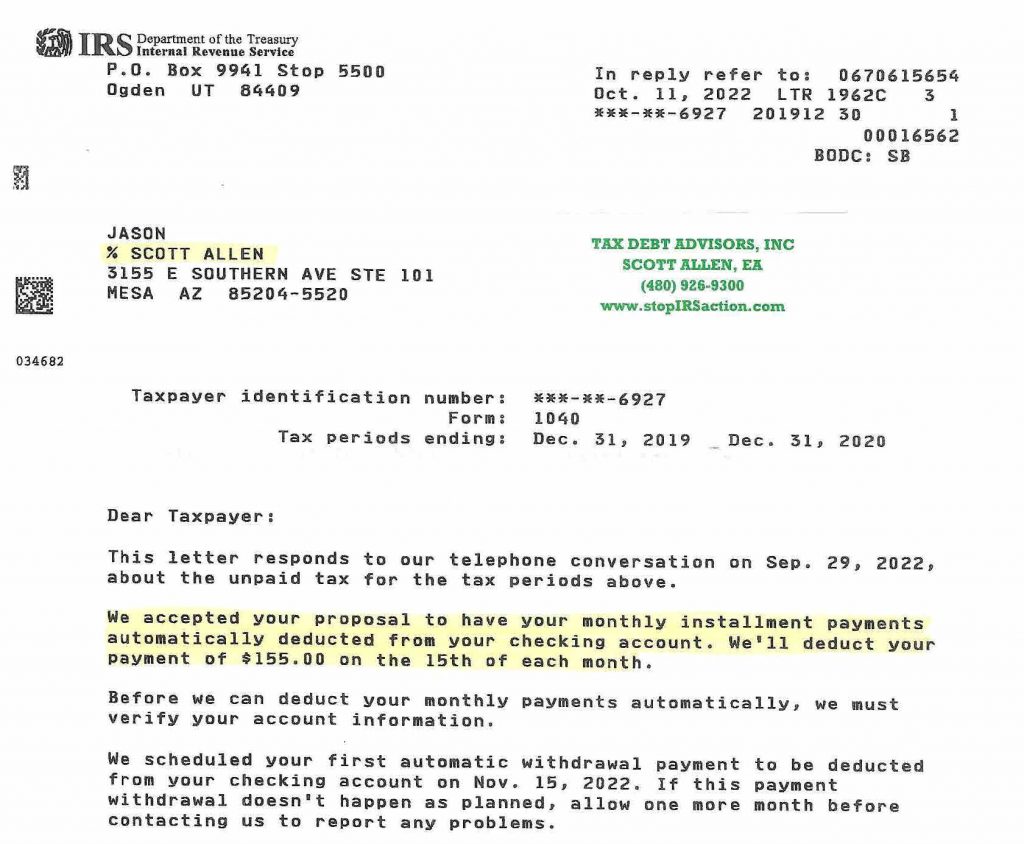

The 100 levy was implemented for. You can request an installment agreement by contacting the IRS tax levy phone number as soon as you receive the notice of the levy. One of the questions I get asked a lot from clients when considering a federal tax debt is whether to institute an automatic stay with their state.

To begin the process of an appeal call the. To remove a tax levy youll need to contact the IRS and ask for the levy to be released. Once that is done find the IRS phone number on your IRS levy notice or call 800-829-1040.

Account or tax law. If youre in bankruptcy the IRS may not be able to levy your assets. If you do not find the number you need below we encourage you to visit the Let Us Help You page on the IRS.

If youre unsure which phone number to call about your specific question then. The Medicare Access and CHIP Reauthorization Act of 2015 increased the amount of the federal payment levy for Medicare Providers from 30 to 100. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

You have the legal right to appeal a tax levy but you must act quickly as the IRS can start seizing your assets within 30 days of sending the notice. You paid the amount you owe and no longer have a balance. The IRS also has specific phone numbers for tax professionals.

Contact the IRS and provide information about your bankruptcy chapter the filing date the court where you. Eastern time for all other questions. During the filing season from January through April the.

Eastern time for tax law questions. The IRS International Call Center is open Monday to Friday from.

Irs Tax Levies Franskoviak Tax Solutions Solving Tax Levy Issues

Guide To Appealing An Irs Tax Levy When How To Appeal

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

How To Release An Irs Levy Remove Federal Tax Levy

Levies Taxpayer Advocate Service

Fun Facts About Irs Bank Levies Washington Tax Services

Irs Levy Tax Matters Solutions Llc

Irs Has Restarted The Income Tax Levy Program

Irs Levy Fears Can Be Overstated Washington Tax Services

Tips To Getting Rid Of An Irs Tax Levy Nick Nemeth Blog

Irs Tax Lien Vs Tax Levy Wiztax

Are You Being Levied By The State Or The Irs

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Irs Tax Liens Tax Levy Usa Tax Settlement

5 12 3 Lien Release And Related Topics Internal Revenue Service